The way people handle money is changing faster than ever before. Around the world, more people are moving away from cash and embracing digital wallets, mobile payments, and cashless systems. These tools are not just about convenience; they are about creating access.

For millions who were once excluded from traditional banking, mobile money has opened doors to saving, borrowing, and participating in the economy. One of the best examples of this transformation is M-Pesa, the mobile money service that began in Kenya and has since become a global case study in financial inclusion. What started as a simple idea has grown into a lifeline for millions of people who had never set foot inside a bank.

What Is M-Pesa?

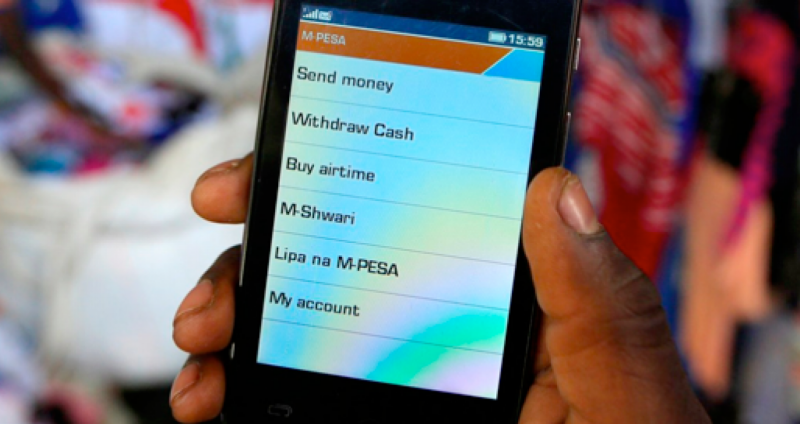

M-Pesa is a mobile money transfer and payment service launched in Kenya in 2007 by Safaricom, the country’s largest telecommunications provider, in partnership with Vodafone. The name stands for “mobile” and “pesa,” which is the Swahili word for money. M-Pesa is special not just for the way it includes people of all backgrounds and economic classes, but also in the versatile uses this single platform offers. The beauty of M-Pesa lies in its simplicity. It does not require internet access or a smartphone. A basic mobile phone with a SIM card is enough, making it accessible to nearly everyone. With M-Pesa, users manage money directly from their mobile phones without needing a bank account or internet access.

Here’s how it works in practice:

- Deposit and withdraw money at local agents: Instead of visiting a bank, people go to nearby shops or kiosks that serve as M-Pesa agents. These agents act like mini-banks. A user can hand over cash to the agent, who then loads the equivalent value into the user’s M-Pesa account (linked to their phone number, not a bank account). The reverse also works; users can withdraw cash by sending an SMS request, and the agent gives them the money.

- Send money instantly: Once money is stored in the M-Pesa account, it can be sent to anyone with a mobile phone. The sender just selects the recipient’s phone number, enters the amount, and confirms with a PIN. The transfer happens instantly, even if the sender and recipient live in remote villages hundreds of miles apart.

- Pay bills, school fees, and shop: M-Pesa is widely accepted as a form of payment in Kenya and other regions where it operates. Users can pay for electricity, water, rent, or school tuition directly from their phones. Many shops, from small market stalls to supermarkets, also accept M-Pesa payments, reducing the need to carry cash.

- Access microloans, insurance, and savings: Over time, M-Pesa partnered with banks and financial institutions to expand services. Through the phone menu, users can apply for small loans, save money securely, or even buy affordable health and life insurance. These services, which were once limited to bank customers, are now accessible to anyone with a phone.

The beauty of M-Pesa lies in its simplicity. It does not require internet data or a smartphone. The system uses simple text messages and a secure PIN code, so even people with the most basic phones can use it. This accessibility is what makes it such a powerful tool for financial inclusion.

How M-Pesa Started

Back in the mid-2000s, most Kenyans did not have access to traditional banks. Opening an account required paperwork, fees, and a minimum balance that many could not afford. At the same time, Kenya had a growing mobile phone network. Safaricom saw an opportunity: what if people could use their phones to transfer money as easily as sending a text? M-Pesa was originally developed as a pilot project to help people repay small loans. Quickly, users discovered its potential for everyday transactions; sending money to family, paying for goods, and avoiding the risks of carrying cash. Adoption skyrocketed, and within a few years, M-Pesa became the default way of moving money in Kenya.

Growth and Impact on Financial Inclusion

Since its launch, M-Pesa has transformed financial access in Kenya and beyond.

- Scale: Today, M-Pesa serves over 50 million active users across multiple countries, including Kenya, Tanzania, Ghana, Egypt, and Mozambique.

- Reach: It operates through more than 600,000 agents, making it easy to deposit or withdraw money in rural villages where banks have no branches.

- Financial inclusion: In Kenya, the percentage of adults with access to formal financial services jumped from less than 30% in 2006 to more than 80% by 2019, largely thanks to M-Pesa.

- Economic impact: Studies show that M-Pesa lifted over 2% of Kenyan households out of extreme poverty, especially women-led households, by enabling safer savings and easier business transactions.

M-Pesa is more than a tool for sending money. It has become a gateway to the broader economy, allowing small businesses, farmers, and families to thrive where cash and banks once held them back.

The Market and Regions It Serves

While M-Pesa began in Kenya, its influence spread across Africa and into parts of Asia and Europe. In Tanzania, Ghana, and Mozambique, it has gained strong traction. In Egypt, it serves millions of users looking for a simple digital alternative to banking.

M-Pesa has also been introduced in markets like India and Romania. Although adoption has varied depending on local banking systems and regulations, the model continues to inspire digital payment solutions worldwide.

How M-Pesa Differs from Other Popular Payment Channels

Globally, services like PayPal, Venmo, or Apple Pay dominate conversations about digital payments. However, M-Pesa is unique in several ways:

- Accessibility: Unlike PayPal or Apple Pay, M-Pesa does not require internet or a bank account. It works on the simplest of phones using SMS technology.

- Agent network: Instead of relying on ATMs or bank branches, M-Pesa uses a vast network of local agents, shops, kiosks, and mobile stalls, where people can deposit or withdraw cash.

- Financial inclusion focus: While many digital wallets target those already banked, M-Pesa’s strength is in reaching the unbanked and underbanked populations.

- Integration with daily life: In Kenya, M-Pesa is deeply woven into society. From paying taxi fares to buying groceries at local markets, it is a standard way of life, not just an alternative.

This combination of accessibility, reach, and integration makes M-Pesa a powerful tool for financial inclusion that stands apart from its global peers.

Lessons from M-Pesa’s Success

M-Pesa’s story holds important lessons not just for Kenyans, East Africans, Africans, but for every Tech-innovator in any part of the world:

- Start with simplicity. The system worked because it solved a real problem in the simplest way possible.

- Leverage existing infrastructure. By using mobile phones and local agents, M-Pesa bypassed the need for expensive banking networks.

- Build trust. Security, reliability, and a strong community presence helped people adopt the system quickly.

- Scale responsibly. Over time, M-Pesa added services like loans and insurance, but it began with the basics to ensure mass adoption.

Conclusion

As economies around the world move toward cashless transactions, M-Pesa stands out as a model of how digital payments can create real social and economic change. It did not just make life more convenient; it gave millions access to opportunities they had been denied for decades. By turning a simple mobile phone into a financial tool, M-Pesa redefined what inclusion looks like.

Its success proves that when technology is designed with people’s needs in mind, it can transform entire economies. For anyone interested in the future of money, M-Pesa remains a powerful reminder: financial inclusion is not just about banks; it is about access, dignity, and empowerment.