Do you often feel like payday arrives just in time, only for the money to disappear just as quickly? If so, you’re not alone. People around the world, regardless of income or lifestyle, quietly face the same struggle: living paycheck to paycheck.

But here’s the truth: this cycle doesn’t define your worth, and it doesn’t have to be permanent. With small, intentional steps, you can move toward financial stability and freedom, no matter where you’re starting from.

Let’s start by unpacking what this lifestyle means and how you can begin to shift it today.

Does Living Paycheck to Paycheck Mean Broke?

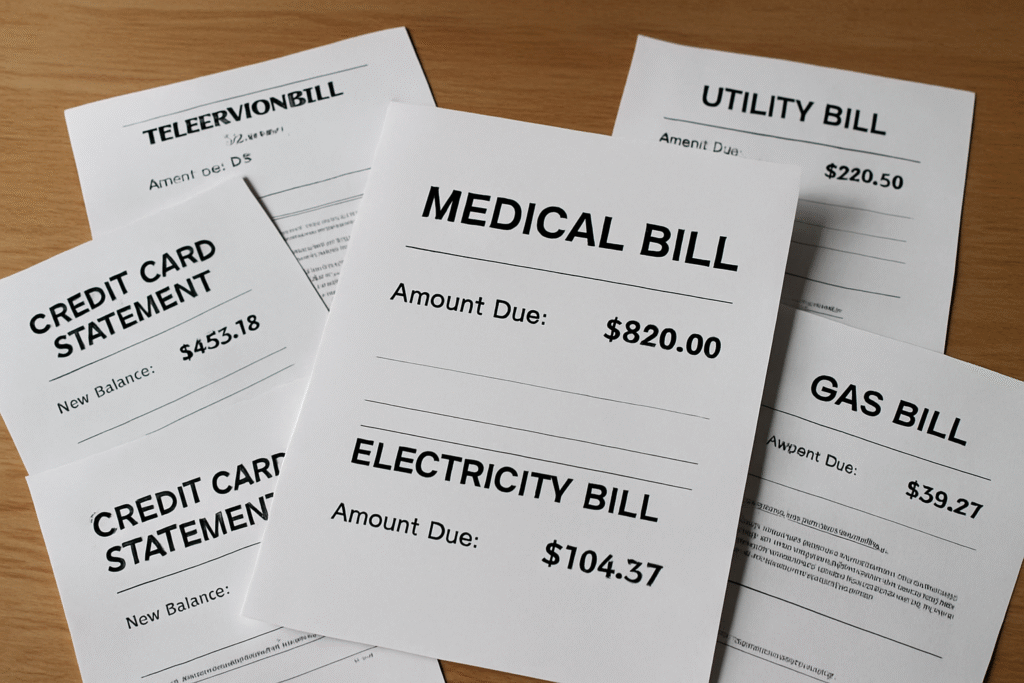

Living paycheck to paycheck means your entire monthly income goes toward covering your basic living expenses, often with nothing left over. There’s little to no buffer. If an emergency comes up, like a car repair or a medical bill, it could throw your entire financial world off balance.

But it’s not always about how much money you earn; it’s often about how your income is managed. Many people earning six figures still live paycheck to paycheck because their expenses rise as their income does. This cycle can exist in Nairobi, New York, Manila, or Madrid; it’s a global issue fueled by rising living costs, debt, lifestyle inflation, and lack of financial education.

Common Signs You’re Stuck in This Money Pattern

Sometimes, we don’t even realize we’re trapped in the cycle. Here are a few signs:

You rely on your next paycheck to cover basic bills like rent, food, or transport.

You feel anxious toward the end of the month, unsure how you’ll make it to payday.

You have no emergency savings, and even small unexpected expenses throw off your whole budget.

You often use credit cards or mobile loans just to “make it through” the month.

Your constantly have to deep into your savings, therefore you never actually save anything. If any of these feel familiar, don’t panic. You’re not failing, you just need a new approach.

Small, Intentional Steps Towards Financial Freedom

- Start With Awareness – Track all the money that comes in and goes out. Awareness is power. Free apps, spreadsheets, or even a small notebook can help you spot patterns and leaks.

- Cut Back Gently, Not Harshly – Look for small recurring expenses you can adjust or eliminate, like that streaming service you don’t use or frequent food deliveries. Frugal living isn’t about deprivation; it’s about intention.

- Build a Tiny Safety Net – Aim to save even a small emergency fund (e.g., $100–$500). This money gives you breathing room. You can start by putting aside whatever you can; consistency matters more than amount.

- Find Simple Ways to Boost Your Income – Sell Unused Items. Offer your skills online. Take on a small weekend gig. Additional income, no matter how modest, can be directed toward savings or debt relief.

- Set a Micro Goal – Choose one simple goal, such as “I want to have $100 saved in 60 days” or “I’ll track my spending for 30 days.” Starting small makes the journey less overwhelming and more empowering.

Living paycheck to paycheck is tough, but it’s not a life sentence. With each intentional decision, you’re reclaiming control and rewriting your money story, moving away from a life of financial struggle.

Financial freedom doesn’t happen overnight, but it does happen through small daily choices. You have what it takes.

Pingback: How to Save Using Mobile Money Accounts in Africa - boldlyfrugal.com